We all keep money in a bank, trusting it's secure behind locked doors and sturdy vaults. Well, imagine if a group of tech-savvy thieves could break into the bank's digital systems and steal your funds without ever setting foot inside the building.

We all keep money in a bank, trusting it's secure behind locked doors and sturdy vaults. Well, imagine if a group of tech-savvy thieves could break into the bank's digital systems and steal your funds without ever setting foot inside the building. That's essentially what happens in online banking fraud. It's like a modern-day bank heist, except the criminals operate from behind computer screens instead of holding up a bank.

What is online banking fraud?

Online banking fraud allows cyber criminals to access your small business’s bank accounts and transfer your hard-earned cash.

This isn’t some rare occurrence – it’s one of the top three reported cyber crimes, according to the Australian Competition and Consumer Commission (ACCC).

So how do these digital bandits pull it off? Cyber criminals use various techniques, like phishing, malware, or hacking, to access your online banking account or steal your banking credentials.

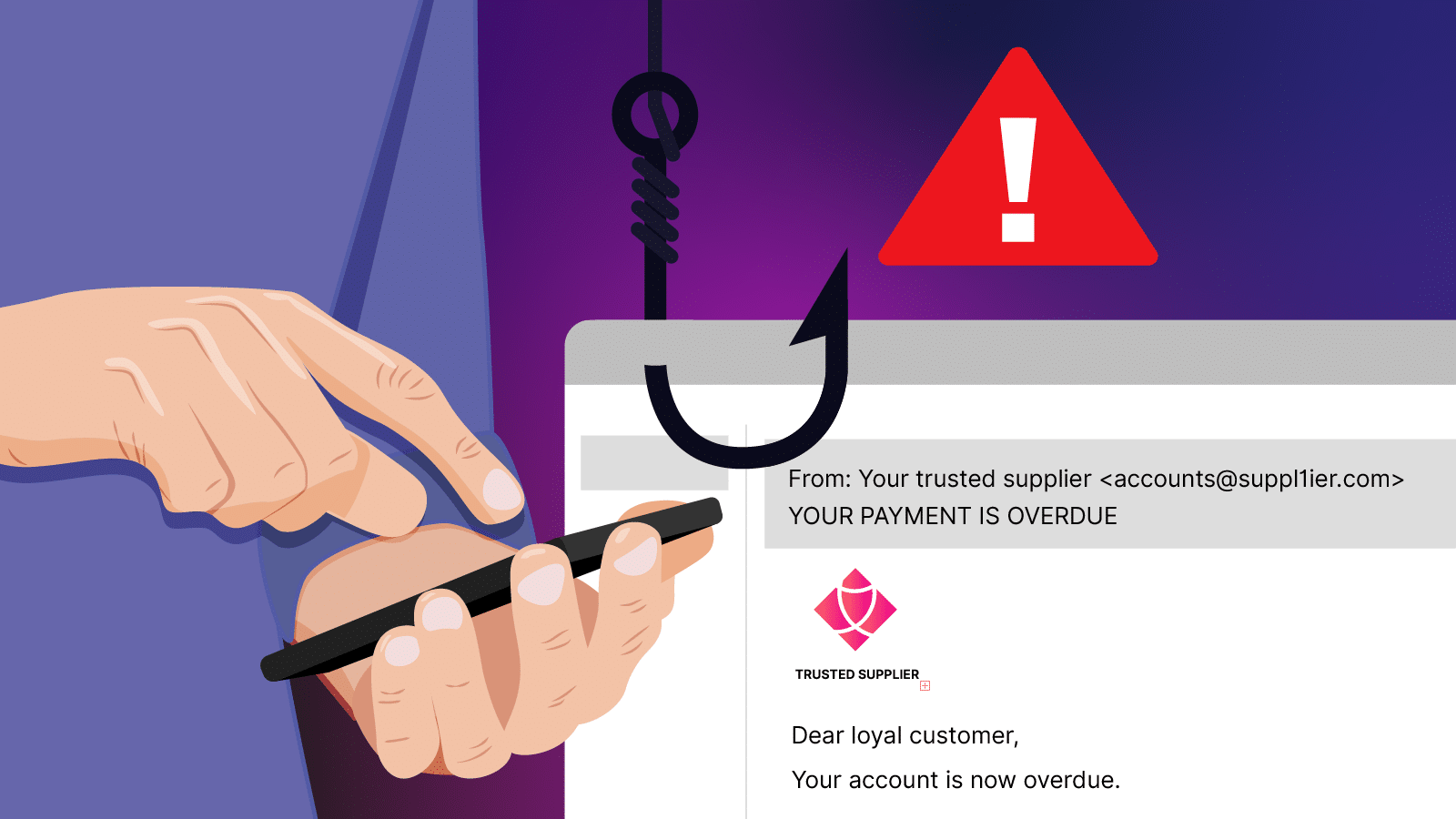

Phishing emails are fake emails designed to trick you into clicking a malicious link or downloading an attachment. These emails often appear to be from legitimate sources, like your bank or even a supplier. Once you click the link or download the attachment, it can install malware on your computer, which can then steal your login details.

How to avoid online fraud?

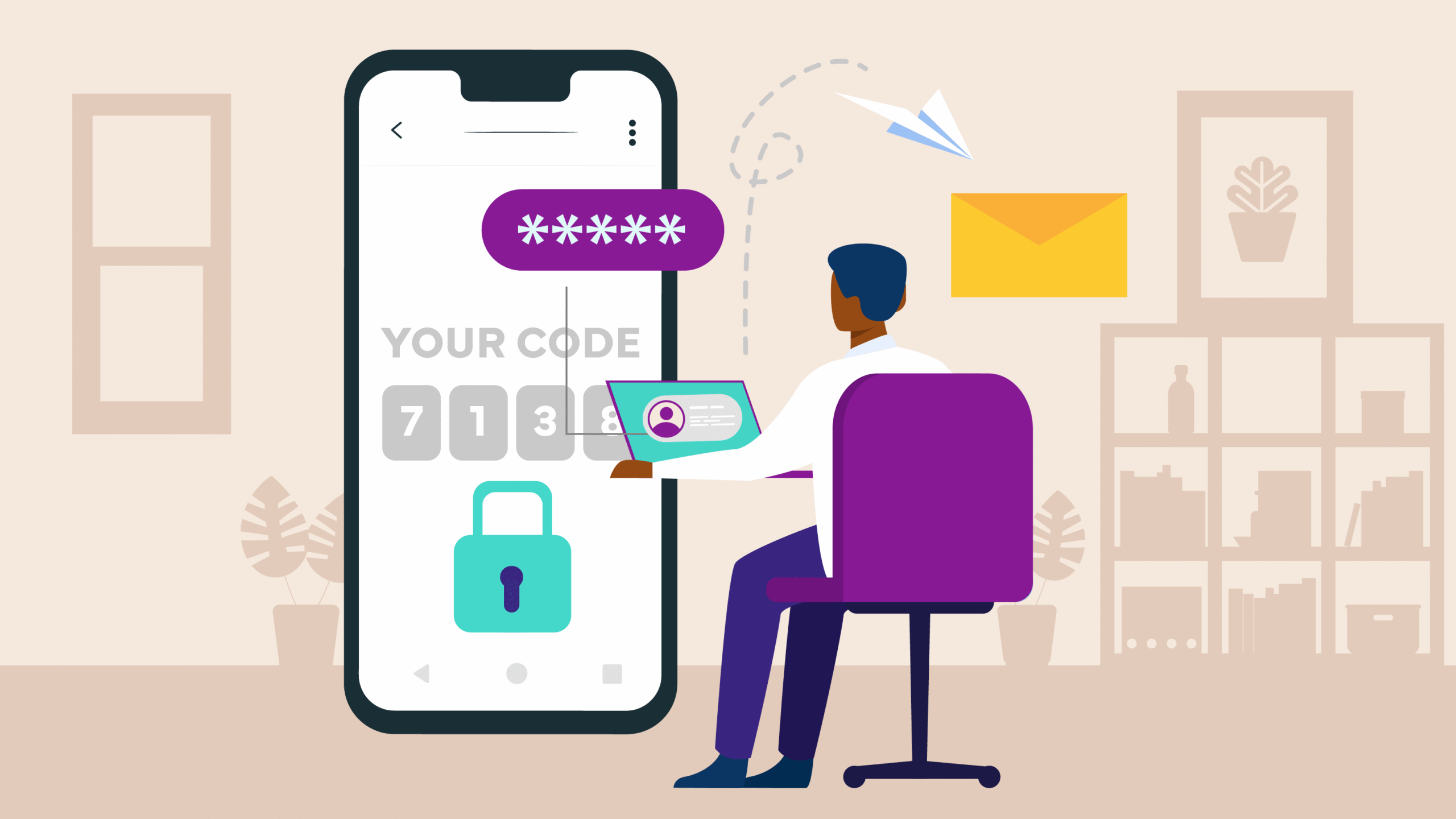

- Strong passwords: This might seem obvious, but it's crucial. Use strong, unique passwords for your online banking accounts and avoid using easily guessable information like birthdays or pet names.

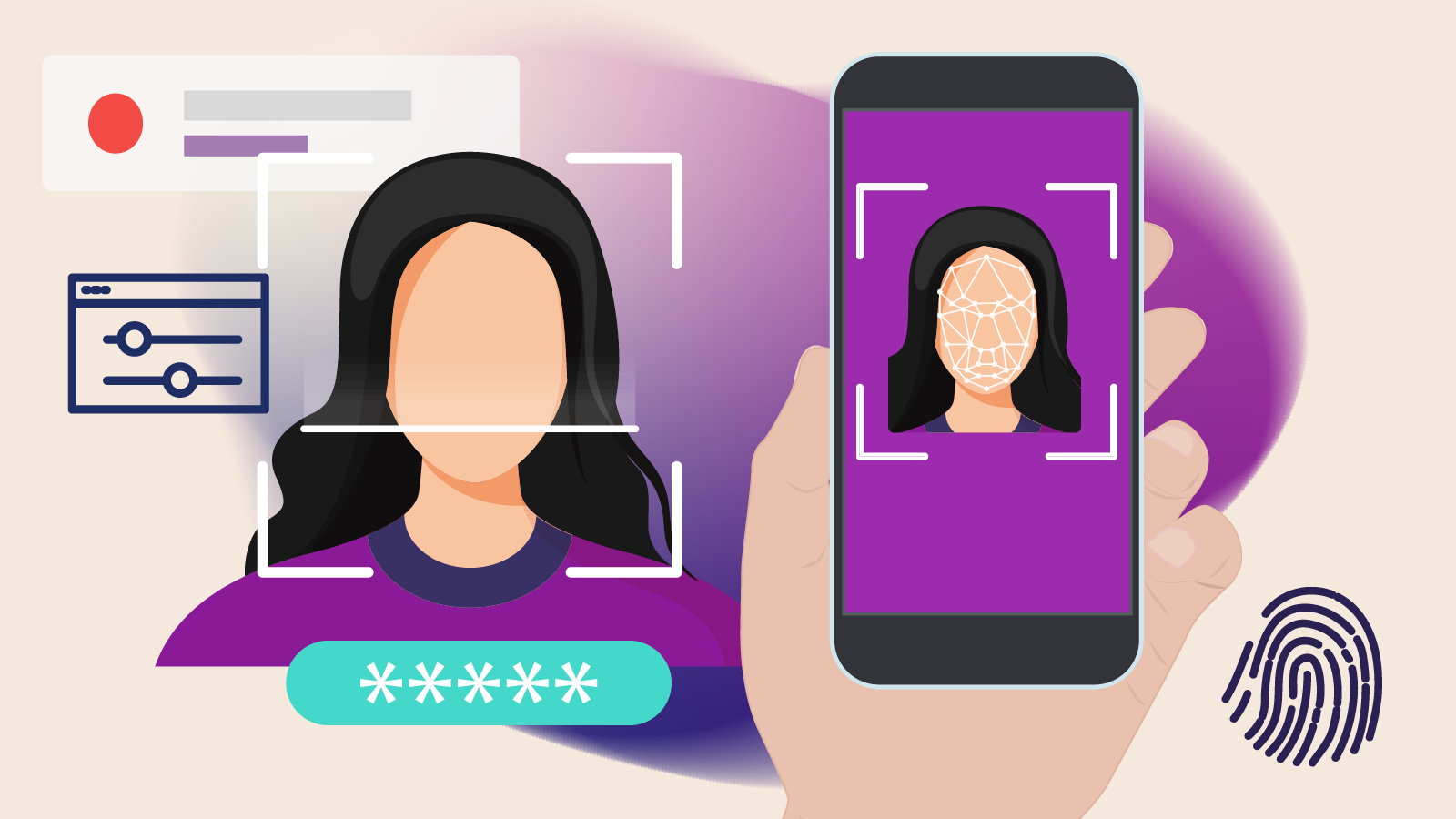

- Multi-factor authentication (MFA): Many banks offer MFA, which adds an extra layer of security by requiring a code from your phone or a security key in addition to your password. Think of it like a two-step verification process for entering your bank's vault.

- Beware of phishing: Don't click on suspicious links or attachments in emails, even if they seem to come from a trusted source. If you're unsure, contact your bank directly using a phone number you know is correct (not one provided in the email).

- Keep software updated: Outdated software can have security vulnerabilities that hackers can exploit. Regularly update your computer's operating system and security software to patch these holes.

- Do Cyber Wardens training: The training will help you build the core skills across cyber security fundamentals, to help avoid online banking fraud and identify phishing attempts.