Australians lost a whopping $2.7 billion to scams in 2023, and with 2024 halfway done, the threats certainly aren’t going anywhere. To ensure they get the results, scammers are constantly evolving their tactics, so staying informed is crucial. Here’s a rundown on some of the most common scams doing the rounds, along with tips on how to avoid them.

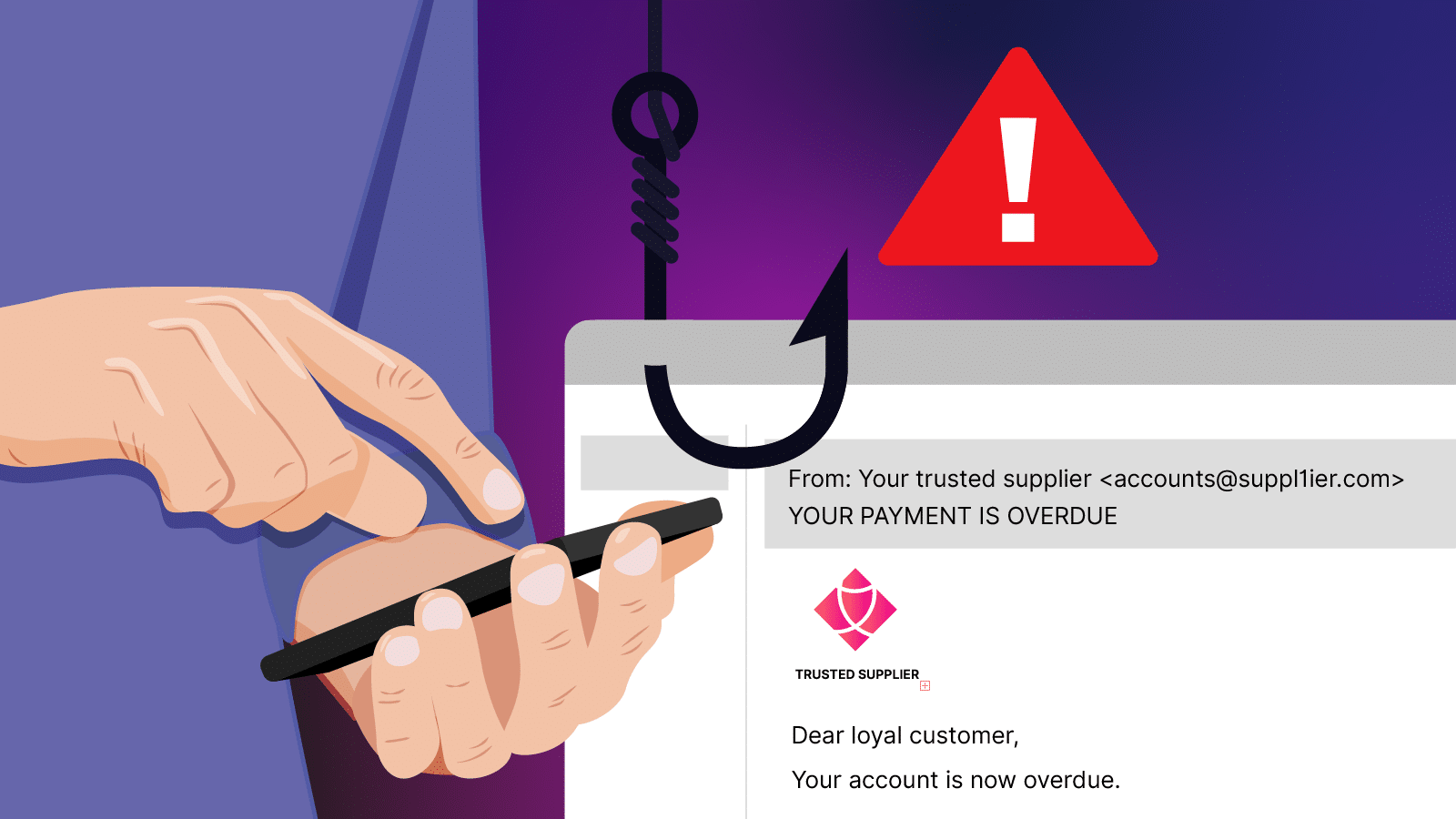

1. Phishing for trouble: impersonation scams

These are the classic ‘bait and switch’ of the digital world. Scammers will pretend to be someone you trust, like your bank, a government agency, or even your long-lost Aunt Mildred. They’ll contact you via phone call, email, or SMS, often with a sense of urgency and a clickable link.

How to avoid

Always verify. Don’t trust caller ID or email addresses at face value. Before taking any action, contact the supposed sender through a trusted channel (like a phone number you know is legit) to confirm the message. Don’t trust suspicious links. And remember, banks or any other legitimate institutions won’t pressure you. They’ll also never ask for personal details or account information over the phone or email.

2. Deceptive deals: selling scams

Buying or selling on platforms like Facebook Marketplace can be a gamble. Scammers prey on both sides, posing as buyers who overpay and request refunds, or sellers who vanish with your cash after receiving payment.

How to avoid

Keep things on the platform, and don’t be lured into taking the conversation elsewhere. Legitimate transactions usually happen within the marketplace’s secure system. Beware of unusual payment methods: Gift cards and crypto are big red flags. Don’t share any of your personal details, and stick to secure payment options offered by the platform where possible. Also always make sure you meet in a safe space.

3. The remote runaround: remote access scams

These scams involve imposters claiming to be tech support or security professionals. They’ll create a sense of urgency, stating you have a potential virus or compromised account, and try to trick you into granting remote access to your device so they can ‘fix it’. Once in, they can steal your personal information, bank details, or wreak havoc on your system.

How to avoid

Remember, banks and legitimate tech companies won’t contact you out of the blue about security issues. Also keep your computer’s security software updated and enabled. Never share your personal details or account passwords over the phone.

No matter the scam, the first step in staying safe is being aware. Cyber Wardens training can help you tune into the common tactics scammers use. Remember, if something seems too good to be true, it probably is, so stay vigilant and don’t be afraid to walk away from a situation that feels fishy.