In the hustle and bustle of running a small business, many things can end up in the ‘too hard basket’.

Clearing the inbox. Tackling the tax. Even a much-needed holiday.

But there’s one important task that should be at the top of your to-do list: cyber security.

Worryingly, about half of small businesses are at serious risk of a cyber attack because they haven’t secured their digital doors with measures such as multi-factor authentication and daily back-ups.

Despite the rising online threat, a third of operators think that rolling out cyber-safe practices is too time-consuming.

One Queensland hospitality business owner says: “I think as a small business we have so many plates spinning and so many other things that are a lot louder and more in your face to tackle than cyber security.

“Personally, it always just falls by the wayside. If it’s not screaming, then it just gets put on tomorrow’s to-do list. It’s not until something happens that it becomes a higher priority.”

But the reality is that shoring up your cyber safety quick and simple with the free, Australian government-backed Cyber Wardens program.

Here’s why you need to care about cyber security before it’s too late.

1. An attack could blow a huge hole in your budget

What does $46,000 mean to your business? A part-time staff member, a prized piece of equipment, a big chunk of the annual rent?

Prepare to part with that money if you are unlucky enough to be the victim of a cyber crime.

On average, an online attack could hit your bottom line by $46,000, and result in your business closing down for days or even weeks.

Is that a gamble you can afford to take? For most small businesses, the answer is no. Particularly when you consider that the average business forks out $40,000 in costs in its first year.

2. You risk losing the trust of your customers

When big brands like The Iconic, Optus and Medibank hit the headlines after being targeted by cyber criminals, their customers were understandably nervous.

Many may have even fled to a rival business. Trust is at the cornerstone of every business/customer relationship, and a cyber attack can quickly erode that.

And in most cases, it’s not as simple as blaming a technical issue. Cyber attacks target people who work in your business, and in 95% of cases they are the result of a human error, not a technology failure.

But by bolstering the cyber capabilities of business owners and their teams, Cyber Wardens is making it easier to prevent attacks.

By becoming a Cyber Warden, you are slamming the door to cyber criminals.

It will also give your customers peace of mind that their data is safe, and keep them coming back.

3. Cyber attacks are rising in frequency and cost

In the time it takes to pop out for a coffee break, three cyber crimes have already been committed around Australia.

A cyber crime is reported in Australia every 6 minutes and the number of incidents increased by 23% in 2023 alone.

And it’s hitting small businesses in the hip pocket, with an 80 per cent increase in annual insurance premiums.

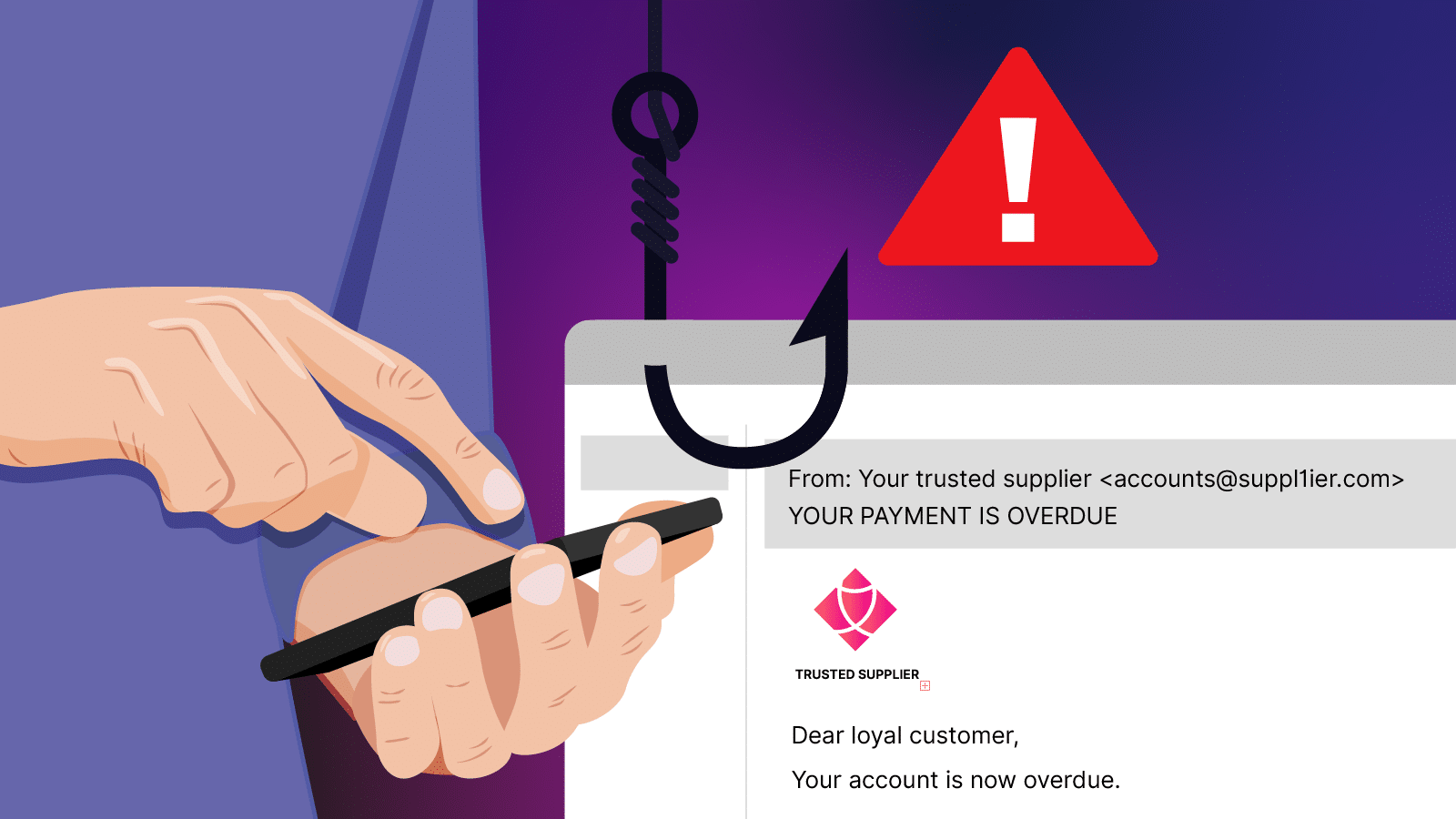

Inbox break-ins, fake invoice scams and banking burglaries are the top three cyber threats that small businesses face.

The country’s 2.5 million small businesses are getting back on track after a pandemic-plagued two years, and they can’t afford another virus.

4. Small businesses are one of the biggest targets of cyber crime

“It won’t happen to me.”

Does this cross your mind when hearing about cyber attacks targeting large companies? You’re not alone.

Many small businesses consider themselves too small to be targeted by cyber crime — but unfortunately, they are wrong.

In Australia, nearly half of cyber security attacks target small to medium businesses.

And over 80% of small business owners and employees have already encountered a cyber threat, both personally and professionally.

5. Bad cyber habits are rife

Stopping scammers in their tracks starts with cleaning up bad cyber habits.

Nearly four in five small business owners (78%) have everyday behaviours that inadvertently make them more vulnerable to cyber crime, Cyber Wardens research has found.

The top bad habits putting small businesses at risk include:

- 1. Hitting snooze on the update button. Automatic updates are there to block newly discovered security holes (aka ‘open doors’) in your systems, so don’t put them off.

- 2. Skipping out on multi-factor authentication (MFA). You can turn on a virtual ‘alarm system’ by setting up MFA on your accounts. With a strong password and MFA, it becomes a lot more difficult for hackers and scammers to get through security.

- 3. Getting lax with backups. Back up your data at least once a week – daily is even better.

- 4. Leaving cyber security for your IT expert. Instead, set up quarterly cyber safety sessions for your team, to remind them about practices in place to make payments, the latest threats going around and policies.